Conquering the Seven Faces of Risk: Automated Momentum Strategies Avoid Bear Markets Empower Fearless Retirement Planning | 被動收入的投資秘訣 - 2024年6月

Conquering the Seven Faces of Risk: Automated Momentum Strategies Avoid Bear Markets Empower Fearless Retirement Planning

Risk is not a one-dimensional problem cured by a single dose of diversification. It's a multidimensional problem, and diversification's passive risk reduction is only just the start. At least since Markowitz developed Modern Portfolio Theory 65 years ago, risk has generally been measured as the standard deviation from average return. However, Behavioral Economics (and even the dictionary) say risk is really about the loss of value, which is quite different from volatility. Risk has at least seven unique faces, including (1) Single-Stock Risk, (2) Market Volatility, (3) Bear Market Crash, (4) Momentum Loss, (5) Backtesting Deception, (6) Strategy Hired/Fired Late, and (7) Retirement Savings Will Not Be Enough. The elephant in the room for the majority of people facing retirement is a serious retirement savings shortfall - which makes their most serious risk about earning sufficient returns. Fortunately, a Royal Society Fellow, a National Medal of Science winner, and a trio of Nobel Laureates have laid the foundation for active risk reduction and forever changed the game. This book intends to shake the very foundation of the sleepy momentum mono-culture that seems happily mired in decades-old, simplistic, risk models that not only fail to treat momentum as the multi-faceted problem it is, but also fail to consider fundamental signal processing methods (older than Modern Portfolio Theory) that reduce the "random walk" part of the signal and improve the probability of making a better investment choice. The good news is two-fold: (1) the book's principles and methods are described in a manner most ordinary investors will easily grasp, and (2) while it is truly complicated under the hood (like my car), software tools make it easy to drive. So, buckle up, turn the page, and let's go for a ride

Scott is a Founder, President and CEO of SumGrowth Strategies of Seattle; the developer of SectorSurfer (for individuals) and AlphaDroid (for financial advisors). He is a panel judge for the prestigious NAAIM Wagner Award, has been granted over 40 U.S. and foreign patents, holds an MSEE from Stanford University, and a BSEE from the University of Wisconsin - Madison. Scott has over 30 years’ experience in both hands-on and executive-level positions, including Founder and President of piTech Engineering, a Seattle, WA engineering consulting firm; Founder and VP of Engineering of IDX Inc., an El Dorado, AR company producing optically encoded and RFID payment systems; and VP of Advanced Engineering at EATON Corporation’s Opcon division for industrial photoelectric sensors in Everett, WA. Scott’s long-term hobby of applying the cross-disciplinary mathematics from the field of electronic signal processing to investment algorithms eventually led to the 2009 launch of SumGrowth Strategies. Scott has become a popular speaker among investment groups throughout the United States, with over 50 engagements in the past 3 years. His published works include: -"Investment Performance Improvement Utilizing Automated Polymorphic Momentum." (2016 NAAIM Wagner Award winner) -"Using Asset Class Rotation to Reduce Risk and Increase Return" (AAII Computerized Investing, Feb. 2017) -"Satisfying the Prudent Man: Quantifying and Defending Risk" (NAAIM Active Manager, April 2017) -"Better Sector Rotation Performance Through Signal Processing and Problem Segmentation" (AAII Computerized Investing, Aug. 2017) -"Photoelectric Sensors and Controls: Selection & Application" (400-page hardcover, Marcel Dekker, New York, 1988).

雅思名師Holly Lin獨家傳授...

雅思名師Holly Lin獨家傳授... 勝率90%的 空單線圖:10分鐘找...

勝率90%的 空單線圖:10分鐘找... 當物理博士遇上巴菲特的價值投資哲學...

當物理博士遇上巴菲特的價值投資哲學... 可愛療癒!鉤織玩偶入門書:一支鉤針...

可愛療癒!鉤織玩偶入門書:一支鉤針... 世界第一簡單!TOEIC TEST...

世界第一簡單!TOEIC TEST... 補教老師的當沖日記 我用K線3年賺...

補教老師的當沖日記 我用K線3年賺... 古狄遜定理K線回應:我們必須在社交...

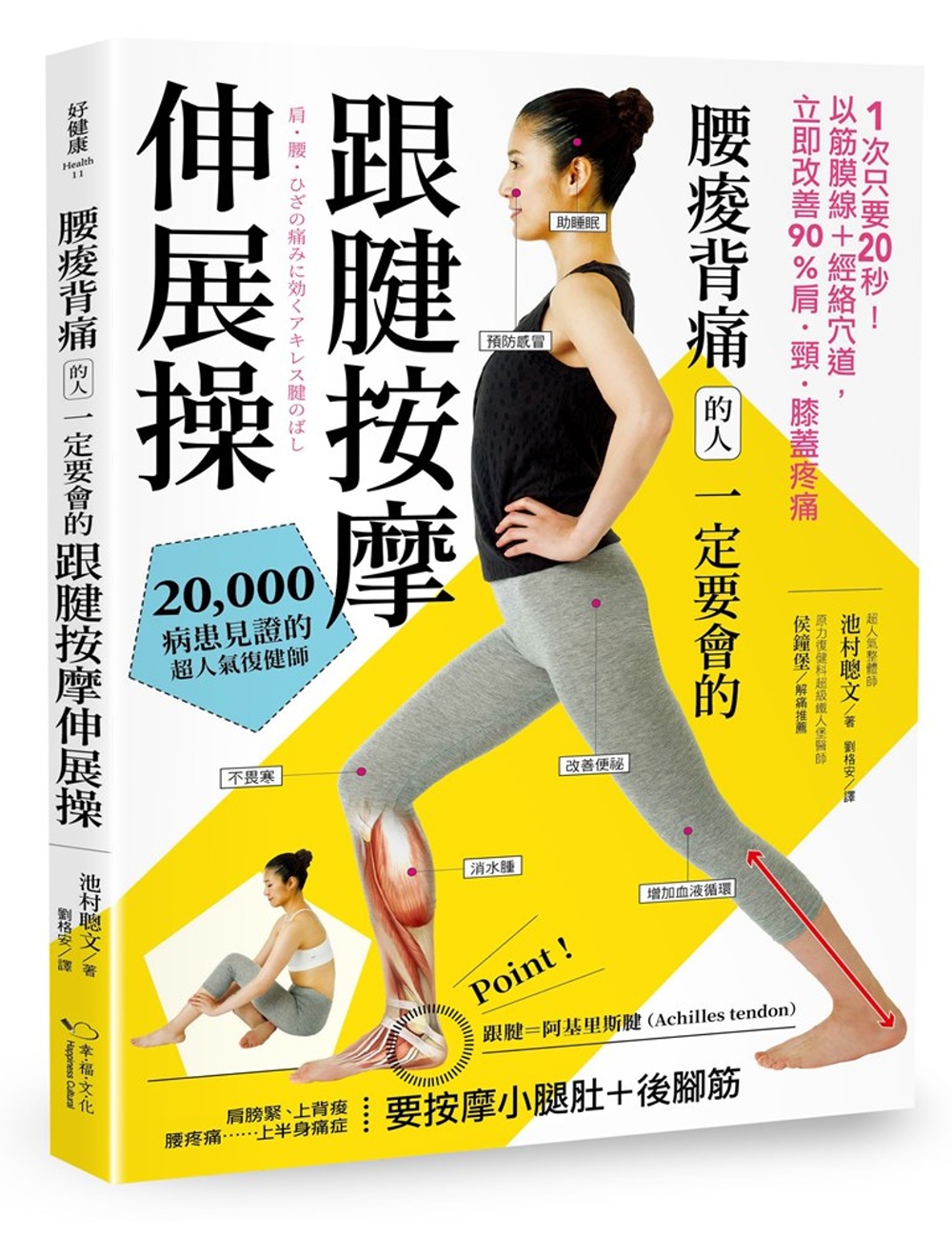

古狄遜定理K線回應:我們必須在社交... 腰痠背痛的人一定要會的跟腱按摩伸展...

腰痠背痛的人一定要會的跟腱按摩伸展... K線理論2:蝴蝶K線台股實戰法

K線理論2:蝴蝶K線台股實戰法 深度數位大掃除:3分飽連線方案,在...

深度數位大掃除:3分飽連線方案,在...