Something for Nothing: Arbitrage and Ethics on Wall Street | 被動收入的投資秘訣 - 2024年9月

Something for Nothing: Arbitrage and Ethics on Wall Street

那些年,華爾街無良的套利遊戲

讓我們先看一個2001年的案例:

高盛跟希臘政府簽訂了一個複雜的金融合約(簡稱假賬)

希臘政府的債務瞬間變少(看起來變少,實際上債台高築)

當這合約在數年後被爆出來後,請問各位:

如果高盛的行為是合法的,那他們在道德上是否有錯?

金融業應該與不道德劃上等號?

「不勞而獲」已成為社會大眾對金融業的既定印象,套利正是遊走在道德邊緣的慣用手法。

在本書中,金融經濟學家Maureen O’Hara解釋對套利的依賴是當代金融其中一項重要的創新,在兩個或以上的市場內找到價差優勢以贏得獲利並減少無效率的經濟活動。當套利被正確的使用,可以用極低甚至無成本的方式創造價值(不勞而獲),但也可能成為一種剝削的工具。

法定規則經常被扭曲成雖然合法但極度不道德的商業手段。透過作者清楚明瞭的羅列主要的案例,從多重觀點檢驗金融道德。範例涵蓋高盛與希臘的交易、雷曼兄弟企圖掩蓋它們的債務、摩根大通在加州操縱電力市場價格、馬多夫長達二十年的龐氏騙局、高頻交易與法國不良資產等重大金融案件。

最終,O’Hara援引哲學與宗教,試圖在金融工業中建立一個新的人本主義道德走向,並提出一些鏗鏘且可行的建議,建立金融從業者的道德責任觀。對於金融體系與道德核心無畏的提問,本書無疑是一本討論當代金融道德的必讀佳作。(文/博客來編譯)

In 2001, Goldman Sachs structured a complex financial contract so that its client, the government of Greece, would appear to have far less debt than it actually did. When news of this transaction came out years later, the inevitable question arose: Even though Goldman's actions were legal, were they ethically wrong? Is modern finance itself inherently unethical?

In Something for Nothing, financial economist Maureen O'Hara explains that one of the key innovations of modern finance is its reliance on arbitrage, the practice of taking advantage of a price difference between two or more markets to generate profits and remove inefficiencies. When done correctly, arbitrage can create value at little or no cost (in effect, getting "something for nothing"); but it can also be an exploitative tool.

In a lucid, insightful discussion of the ethics of arbitrage in modern finance, O'Hara reveals how the rules can often be stretched into still-legal yet highly unethical business practices. Examining key cases in clear and persuasive prose, O'Hara illuminates various aspects of financial ethics, from the Goldman Greek transaction to Lehman Brothers' attempt to cover up its debt, JPMorgan Chase's maneuvers in California's energy markets, Bernie Madoff's trading strategies in the 1980s, high-frequency trading practices, and toxic loans in France.

Ultimately, O'Hara turns to philosophy and religion to argue for a new, humanistic approach to ethics in the financial industry. She makes a strong case for a way forward: fewer rules and more standards to foster a morally responsible outlook. Fearlessly raising the questions at the moral heart of our financial system, Something for Nothing is a masterful treatise on the ethics of modern finance.

股人阿勳教你價值投資:圖解基本面,...

股人阿勳教你價值投資:圖解基本面,... 超級績效2:投資冠軍的操盤思維

超級績效2:投資冠軍的操盤思維 受用一生的耶魯金融投資課:看清市場...

受用一生的耶魯金融投資課:看清市場... 趨勢投資高手的88堂台股必修課:從...

趨勢投資高手的88堂台股必修課:從... 關鍵時刻下的13堂投資心法與實作課...

關鍵時刻下的13堂投資心法與實作課... 投資心理戰:行為金融專家教你看透群...

投資心理戰:行為金融專家教你看透群... 投資之路:改變華爾街遊戲規則的巨人...

投資之路:改變華爾街遊戲規則的巨人... 我畢業五年,用ETF賺到400萬:...

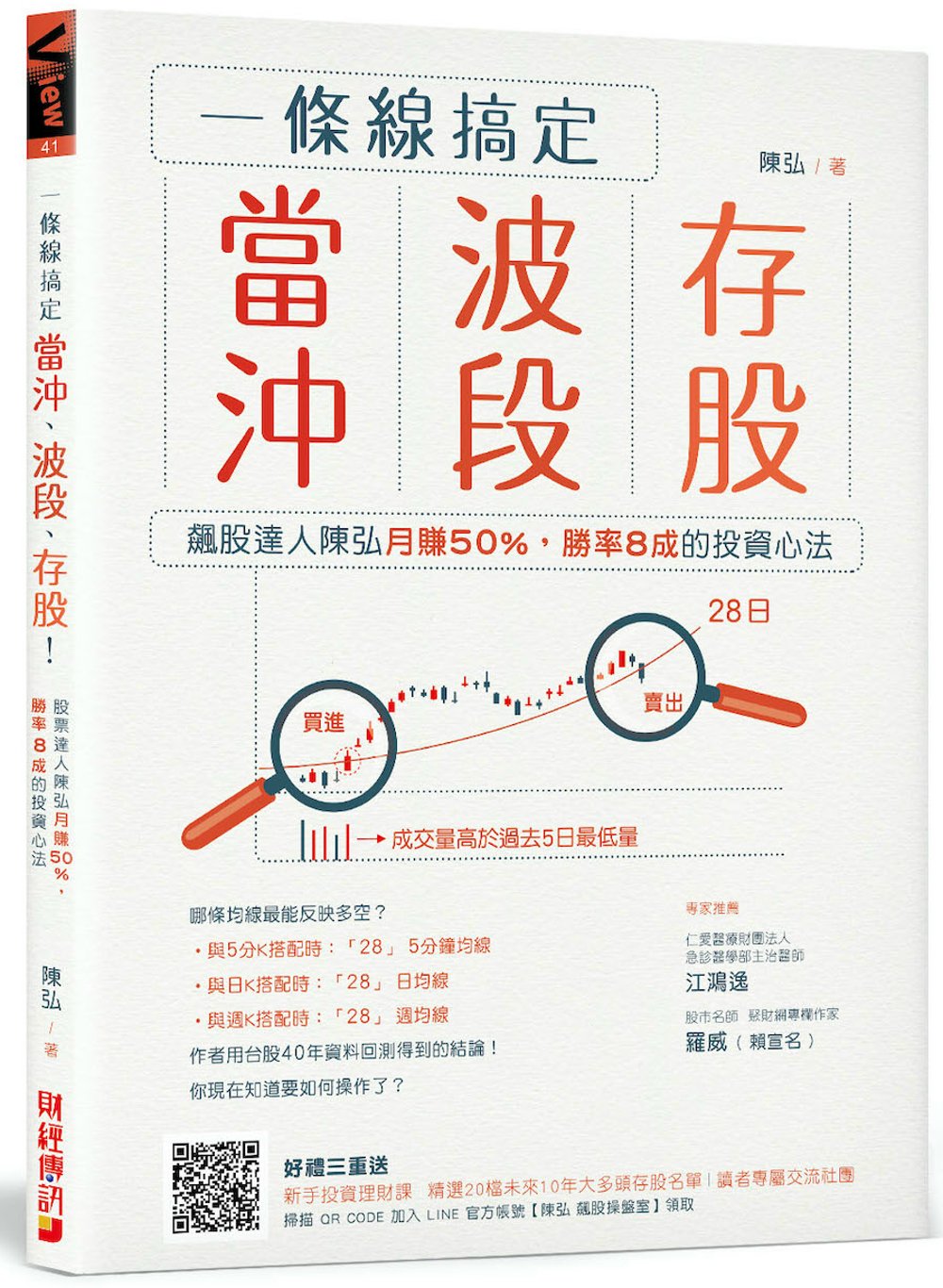

我畢業五年,用ETF賺到400萬:... 一條線搞定當沖、波段、存股!:飆股...

一條線搞定當沖、波段、存股!:飆股... 漫步華爾街:超越股市漲跌的成功投資...

漫步華爾街:超越股市漲跌的成功投資...